internet tax freedom act 1998

This title may be cited as the Internet Tax Freedom Act. The Internet Tax Freedom Act formerly known as S442 now Title XI of PL.

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

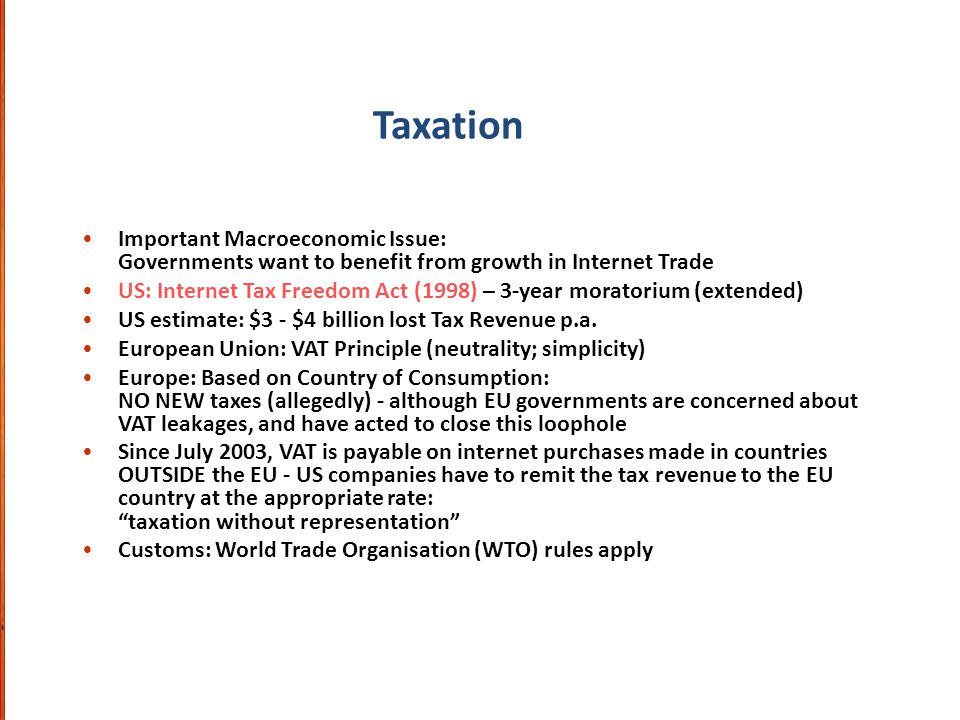

Congress addressed the controversial issue of taxation and e-commerce with the passage of the Internet Tax Freedom Act ITFA which took effect in October 1998.

. 1998 The Internet Tax Freedom Acts Advisory Commission on Electronic Commerce. 442--Internet Tax Freedom Act CBO estimates that enacting S. Originally enacted in 1998 as a temporary moratorium barring federal state and local governments from imposing internet access taxes as well as multiple or discriminatory taxes on electronic commerce ITFA was renewed eight separate times before being made permanent in 2015 under the Trade Facilitation and Trade Enforcement Act of 2015 Act.

The Internet Tax Freedom Act ITFA Title XI of the Omnibus Appropriations Act of 1998 was approved as HR. MORATORIUM ON CERTAIN TAXES. The Act was intended to increase Internet use in the United States.

3529 including cost estimate of the Congressional Budget Office represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Indiana State Library. 442 would result in new discretionary spending of less than 1 million over the 1998- 2003 period assuming appropriation of the necessary amounts. 105277 text PDF on October 21 1998 by President Bill Clinton in an effort to promote and preserve the commercial educational and informational potential of the Internet.

The act made permanent a temporary moratorium on such taxes that has been in placethanks to multiple short-term extensionssince the Internet Tax Freedom Act of 1998 ITFA. Internet Tax Freedom Act Legislation in the United States originally passed in 1998 and renewed several times since that prohibits state and local governments from taxing the use of the Internet. The ITFA put a bar on the states and the localities from imposing taxes on internet access.

2 In addition to. Because the bill would not affect direct spending pay-as-you- go procedures would not apply. Notably the new act phases out a grandfather clause that has protected a handful of states Texas is among them allowing those states to tax Internet access despite the general.

This Act may be cited as the Internet Tax Freedom Act of 1998. 4328 by Congress on October 20 1998 and signed as Public Law 105-277 on October 21 1998. Congress voted to pass the legislation.

The law bars federal state and local governments from taxing Internet access and from imposing discriminatory Internet-only taxes su. The permanent Internet Tax Freedom Act ITFA 47 USC. A AMENDMENT- Title 4 of the United States Code is amended by adding at the end the following.

The Internet Tax Freedom Act and Federal Preemption Congress enacted the Internet Tax Freedom Act to establish a moratorium on the imposition of state and local taxes that would interfere with the free flow of interstate commerce over the internet. 1 taxes on Internet access unless such tax was generally imposed and. Jun 17 1998.

CHAPTER 6--MORATORIUM ON CERTAIN TAXES Sec. 1 Internet access taxes imposed under specified State. ITFA which prohibited states and localities from applying taxes on internet access or imposing discriminatory digital-only taxes became permanent in 2016 but included a grandfather clause that allowed states with taxes existing before 1998 to keep that.

On 1 st October 1998 the US government enacted the Internet Tax Freedom Act ITFA with the intent to further promote and develop the internet technology. 151 note preempts state and local. The Internet Tax Freedom Act ITFA enacted in 1998 was intended to protect the developing internet technology.

The internet tax freedom act of 1998 itfa. It also established the advisory commission on electronic commerce. It also established the Advisory Commission on Electronic Commerce.

The item Internet Tax Freedom Act of 1998. The Internet Tax Freedom Act was first enacted on Oct. 105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1 new taxes on Internet access and 2 multiple or discriminatory taxes on electronic commerce.

105-277 imposed on state and local governments a three-year moratorium from october 1 1998 to october 1 2001 on 1 new taxes on internet access and 2 multiple or discriminatory taxes on electronic commerce. 442 may be brought to the Senate floor again in the next few days. Online sellers are still required to collect sales tax when selling items to buyers in states where you have sales tax nexus.

1 1998 when the US. TITLE XIMORATORIUM ON CERTAIN TAXES SEC. Internet Tax Freedom Act of 1998 - Prohibits for three years after enactment of this Act any State or political subdivision from imposing assessing collecting or attempting to collect taxes on Internet access bit taxes or multiple or discriminatory taxes on electronic commerce with exceptions for.

October 9 1998 Web posted at 1125 AM EDT by Nancy Weil IDG -- The US. For example states and municipalities may not tax e-mails or bandwidth use. This law placed a moratorium on the special taxation on the internet.

Senate voted Thursday 96 to 2 to approve a bill that places a prohibition on. Advisory commission on electronic commerce. CONGRESSIONAL BUDGET OFFICE COST ESTIMATE S.

The managers amendment that will. According to the legislations sponsors ITFA was enacted to create a tax. The Internet Tax Freedom Act of 1998 ITFA.

The 1998 Internet Tax Freedom Act is a United States law authored by Representative Christopher Cox and Senator Ron Wyden and signed into law as title XI of PubL. 105-277 the Omnibus Appropriations Act of 1998 reproduced below establishes the Advisory Commission on Electronic Commerce. Internet Tax Freedom Act - Title I.

Moratorium on Certain Taxes - Prohibits a State or political subdivision thereof from imposing the following taxes on Internet transactions occurring during the period beginning on October 1 1998 and ending three years after the date of enactment of this Act. Report to accompany HR. To establish a national policy against State and local interference with interstate commerce on the Internet or online services and to excise congressional jurisdiction over interstate commerce by establishing a moratorium on the imposition of exactions that would interfere with the free flow of commerce via the Internet.

While the Internet Tax Freedom Act ITFA and its permanent counterpart PIFTA prevents states from imposing taxes on things like actually accessing the internet they do not have anything to do with eCommerce sales. ITFA prohibited the imposition of new e-commerce taxation from October 1 1998 to October 21 2001. Preserving Flexibility to Consider All Options by Michael Mazerov Summary The Internet Tax Freedom Act ITFA S.

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

What Is The Internet Tax Freedom Act Howstuffworks

Is A Global Internet Tax Coming In 2021 The Hill

Michael Mazerov Center On Budget And Policy Priorities

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

Ethical Legal And Public Policy Issues In E Business Ppt Download

Controversial Internet Tax Freedom Act Becomes Permanent July 1

Constitutional Authorities Under Which Congress Regulates State Taxation Everycrsreport Com

What Is The Internet Tax Freedom Act Howstuffworks

Samantha K Breslow Published In Tax Notes State Internet Tax Freedom Act Protector From The Tax Man

California Tax Policy And The Internet

What Is The Internet Tax Freedom Act Howstuffworks

Internet An Overview Of Key Technology Policy Issues Affecting Its Use And Growth Everycrsreport Com