indiana estate tax return

If there is tax due report the tax. If you are the widower or.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

If you are filing a calendar-year return please enter the 4-digit tax year in the box YYYY.

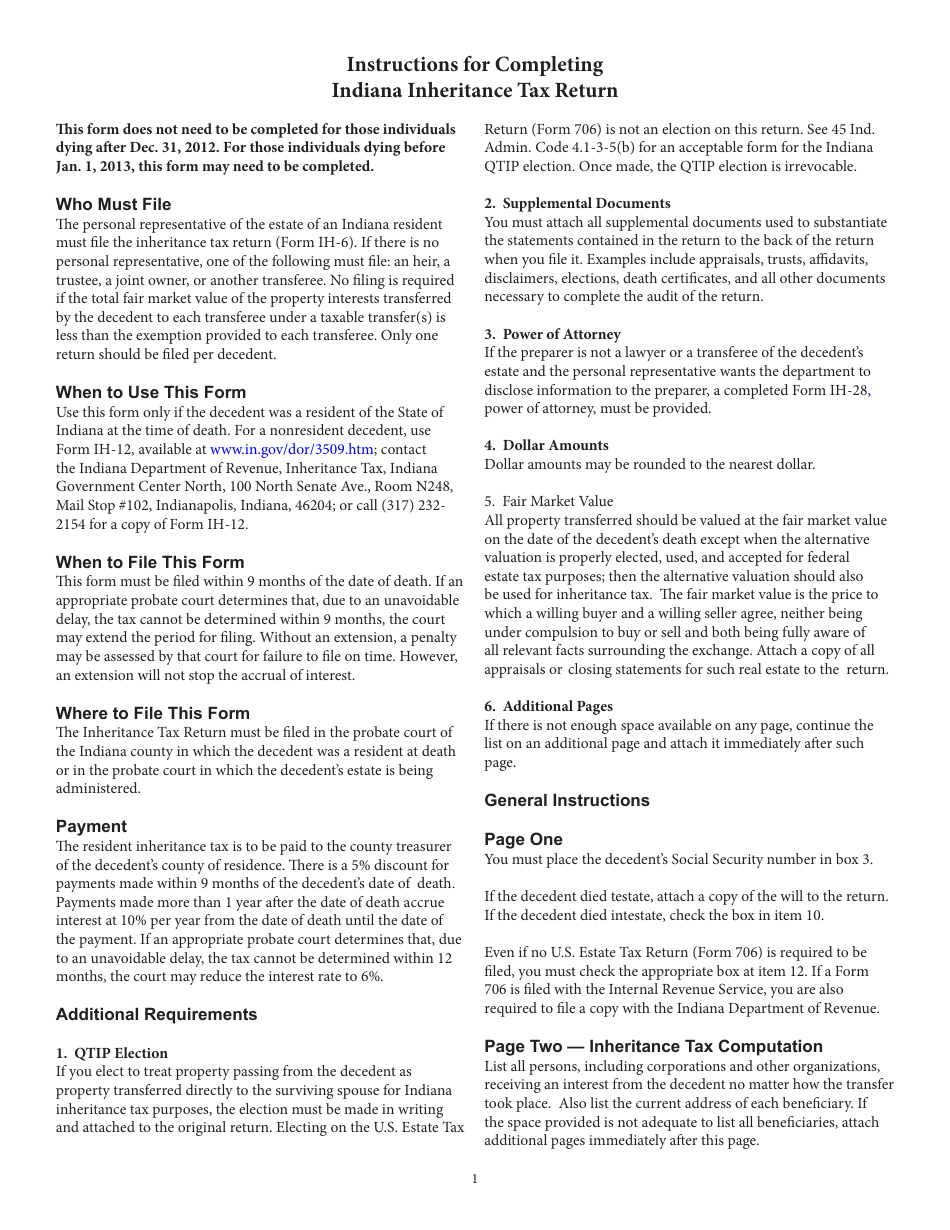

. Income Tax Return for Estates and Trusts. The deceased was under the age of 65 and had adjusted gross income more. Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note.

Indiana repealed the estate or inheritance tax for all those who die after December 31 2012. 5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706 has been filed. Individuals IT-40 Indiana Individual Income Tax Return.

If you are filing a. This tax return is used by the fiduciary representative to report the income deductions gains losses etc. Find Indiana tax forms.

You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am430 pm ET or via our mailing. Department of the Treasury. Preparation of a state tax return for Indiana is available for 2995.

More information is available on DORs Automatic Taxpayer Refund information page. 50217 Fiduciary Payment Voucher 0821. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

For more information check our list of inheritance tax forms. Therefore no inheritance tax returns must be filed at this time. The types of taxes a deceased taxpayers estate can owe are.

An Indiana resident tax return means you filed your state taxes using one of the following. The income that is. Fill-in pdf IT-41 Schedule IN K-1.

E-File is available for Indiana. Indiana Estate Planning Elder Law Hunter Estate Elder Law is an estate planning and elder law firm with a focus on asset protection wills trusts Medicaid planning Veterans benefits. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Contact a district office of the Indiana Department of Revenue see Resources. The executor administrator or the surviving spouse must file an Indiana income tax return for the individual if. Indiana Fiduciary Income Tax Return 0821 fill-in pdf IT-41ES.

55891 Beneficiarys Share of Indiana Adjusted Gross. Please read carefully the general instructions before preparing. By telephone at 317-232-2240 Option 3 to access the automated refund line.

To 430 pm Monday through Friday with the exception of. 4810 for Form 709 gift tax only. Know when I will receive my tax refund.

Of the estate or trust. All district offices have hours from 8 am. Indiana Full-Year Resident Individual Income Tax Return.

Taxpayer as shown on Form 1041 US. Direct Deposit is available for Indiana. Individual trust guardian or estate.

Indiana Estate and Inheritance Tax Return Engagement Letter - 706 US Legal Forms offers state-specific forms and templates in Word and PDF format that you can instantly download fill. Indiana estate tax return Wednesday August 31 2022 Edit. The fiduciary return will report only the amount of tax computed on the individual income tax return.

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

Estate Tax Returns Estate Planning Estate Settlement The American College Of Trust And Estate Counsel

Complete Guide To Probate In Indiana

Indiana Property Tax Calculator Smartasset

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

Indiana Estate Tax Everything You Need To Know Smartasset

State Death Tax Hikes Loom Where Not To Die In 2021

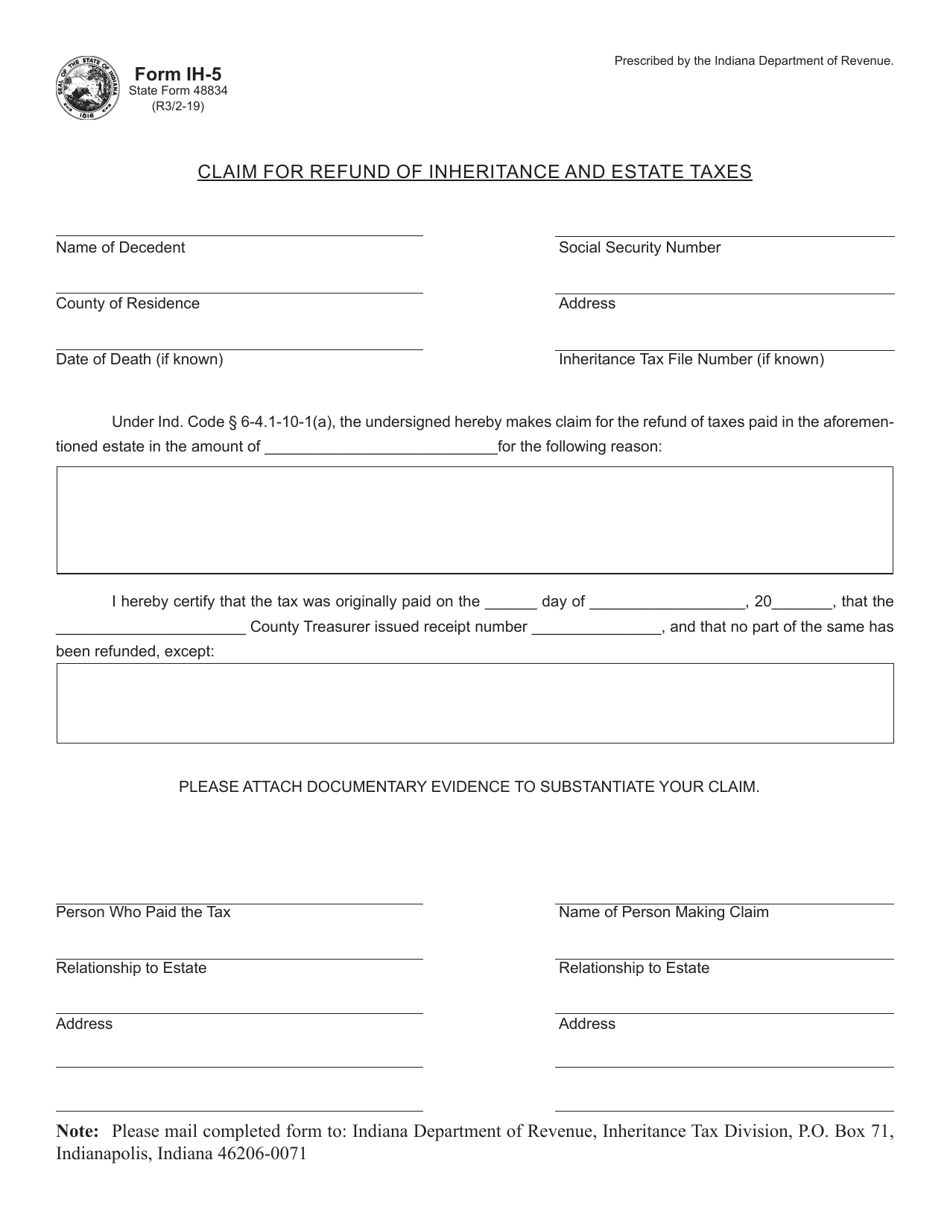

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

Free Form Ct 706 Nt Estate Tax Return For Nontaxable Estates Free Legal Forms Laws Com

Indiana Inheritance Laws What You Should Know Smartasset

Guidelines For An Executor Of An Estate In Indiana Indianapolis Estate Planning Attorneys

Get An Extension If You Can T File Your Tax Return On Time Don T Mess With Taxes

Indiana State Tax Information Support

Property Tax Calculator Smartasset

How To File Income Tax Returns For An Estate 14 Steps

State By State Estate And Inheritance Tax Rates Everplans

Death In The Family Turbotax Tax Tips Videos

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

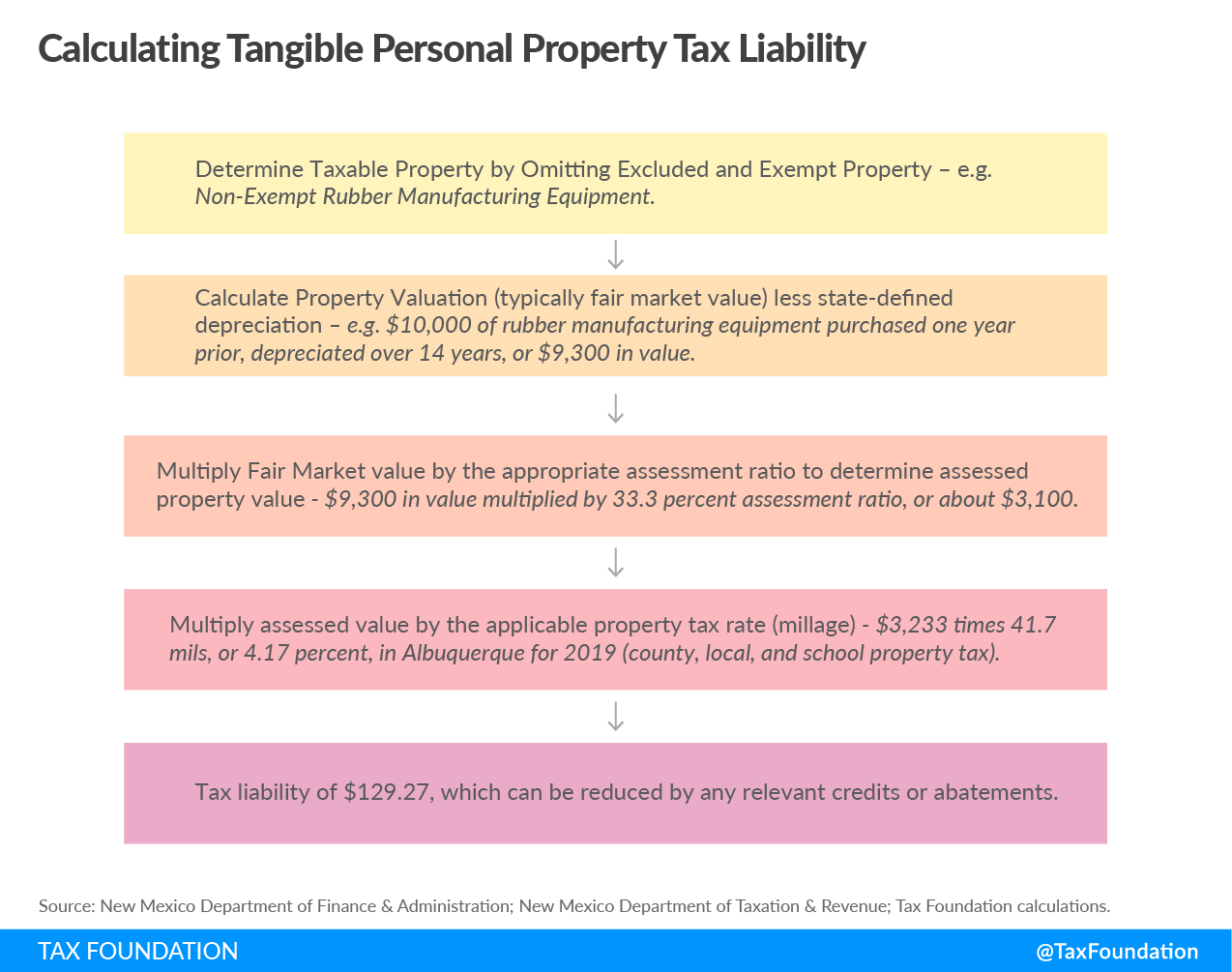

Tangible Personal Property State Tangible Personal Property Taxes